The Best Free Stock Platforms For Your Family

Here’s the thing about investing: The sooner you start, the better. And we found a company that will give you free stock to get started.

A year ago I started giving my kids investments instead of cash for their chores. Each chore has a value and at the end of two weeks their earnings go into a Schwab account. We talk about which stock to invest in and then watch the waves of ups and downs.

With any of these platforms, I’ve tried to use ChartPrime to look at trading indicators that give you a crucial trading advantage by revealing exactly where smart money is moving.

Robinhood

An investing app called Robinhood will give you free stock worth between $5 and $200 just for downloading its free app and funding your account. They now have a kids accounts which is cool.

Yeah, you’ve probably heard of Robinhood. Both investing beginners and pros love it because it doesn’t charge commission fees, and you can buy and sell stocks for free — no limits. Plus, it’s super easy to use.

Whether you’ve got $5, $100 or $800 to spare, it takes just a couple of minutes to sign up, fund your account and get your free stock — a nice boost to help you build your investments.

Robinhood offers users a platform to invest in stocks, ETFs, options, and cryptocurrencies, all commission-free, right from your phone or desktop. In addition, Robinhood also offers fractional shares(ability to purchase a share like Amazon for as low as $1), cash management(earn interest on your uninvested cash), DRIP(dividend reinvestment), and an IRA(retirement account with 1% match). Sign up at Robinhood and get up to $200 in free stock.

SoFI

SoFI will give you $25 for starting an investment account. SoFI is an online bank offering a wide range of financial services, including high-yield checking and savings accounts, loans, and investment options.

Depositing cash is less convenient than with a traditional bank. You must use a retail partner in the Green Dot network, which often incurs a fee.

You can start investing with as little as $1, and recurring investments are available. As of late 2024, SoFi began charging a 0.25% annual management fee for its robo-adviser service, a shift from its long-standing fee-free model. It’s also not great for day trading but works for long term trading.

Access to Certified Financial Planner (CFP) professionals for all SoFi members using the platform.

SoFi Plus members have access to additional services, including unlimited one-on-one sessions with a financial advisor and an unlimited 1% match on recurring deposits.

Interactive Brokers

Interactive brokers is one of my favorite trading platforms. Open an account today and start earning up to $1000 of IBKR Stock for free. I also like that they have a module on sustainable investing.

Interactive Brokers has long been a popular broker for advanced traders, but in 2019, the company launched a second tier of service — IBKR Lite — for more casual investors. With IBKR Lite, you get unlimited free trades of stocks and exchange-traded funds that are listed on U.S. exchanges.

If you're interested in trading other investments, including options, futures, mutual funds, crypto, fixed income and more, you can do that on hundreds of exchanges in dozens of countries.

Take a position on key elections, indicators, and trading events with IBKR ForecastTrader. Users can trade yes-or-no predictions in different categories, including politics, economics, finance and climate indicators. Trading is available around the clock, six days a week. You will also earn 3.83% APY on your investment with an interest-like incentive coupon. Plus, you will receive USD 3.00 you can use to trade Forecast Contracts.

IBKR Pro is geared toward advanced traders. If that's you, you'll probably like the broker's per-share pricing of $0.005 per share, advanced trading platform, and unmatched range of tradable securities — including foreign stocks.

By most measures, Interactive Brokers excels when it comes to investment selection. But unlike some other brokers, it does not offer users a way to invest in initial public offerings (IPOs).

Interactive Brokers offers accredited investors access to investments that are generally not available to the public, such as hedge funds. It also offers a variety of tools and specialized accounts for investment professionals such as fund managers, financial advisors and family offices.

IBKR Pro users pay small commissions on stock trades in exchange for faster and more price-efficient order execution. They can choose between a fixed $0.005 per share commission, or a variable commission between $0.0005 and $0.0035 per share depending on volume. IBKR Pro users can also get a volume discount on options trades, and can pay as little as $0.15 per contract or as much as $0.65. Certain ETFs are commission-free for Lite and Pro users alike.

Coinbase

I’ve been using Coinbase for all of my crypto currency holdings. It was easy to move my wallets into here and easily integrate with my bank account. Plus they give you a debit card for even easier access to you coins.

Coinbase is one of the most popular cryptocurrency platforms, offering users a straightforward option for buying, selling, converting, and managing digital assets. It offers 360+ cryptocurrencies to trade plus over 400 unique trading pairs as well as staking to earn some interest.

Coinbase carries crime insurance to protect users’ assets against failures in Coinbase security. It’s important to note that this insurance will not protect you if you give out your password to a third party. USD deposits made by US citizens are insured by the FDIC up to $250,000.

On both the website and the mobile app, new users can jump right in and start trading once their account is approved. Keep in mind that Coinbase is regulated by the SEC and the approval process may take a few days for US residents.

Trading View

Trading View will give you $15 for signing up. Trading View is great for more advanced investors.

TradingView supports everything from stocks and ETFs to bonds, options, futures, cryptocurrencies and forex, making it very easy to track markets in one place.

It has a strong community with idea-sharing and social features. It is advanced, with highly customizable charting tools with over 400 indicators. It provides a powerful set of charting features, a huge library of indicators, and the ability to code custom strategies using Pine Script, its own coding language.

TradingView shines through its powerful backtesting, deep market screening capabilities, and ability to run sophisticated analysis across multiple assets. The extensive Pine Script library offers over 100,000 community-built indicators, making it ideal for experienced users seeking advanced technical analysis and automated strategies.

Sadly, many essential features are locked behind paid subscriptions. If you intend to use it for day trading, expect frequent pop-ups urging you to upgrade, even for basic features.

Acorns

Acorns is a great robo-investing tool to setup an automated way to invest so you can set it and forget it. Get $5 now for signing up. I’ve been with Acorns for years and setup an automatic monthly deduction from my bank account. I often forget about this and later realize I have a nice little nest egg for fun activities.

Acorns is a micro-investing platform best for beginners and passive investors who want a hands-off approach to saving and growing their money. The app automatically invests your spare change from everyday purchases and offers various investment, banking, and retirement products.

Silver and Gold members receive a percentage match (1% and 3% respectively) on contributions to IRA accounts.

In addition to adding lump sums to your investments, Acorns lets you round up your purchases on linked credit or debit cards, then sweep the change into a computer-managed investment portfolio.

Because of its pricing structure, Acorns can have high fees on small account balances.

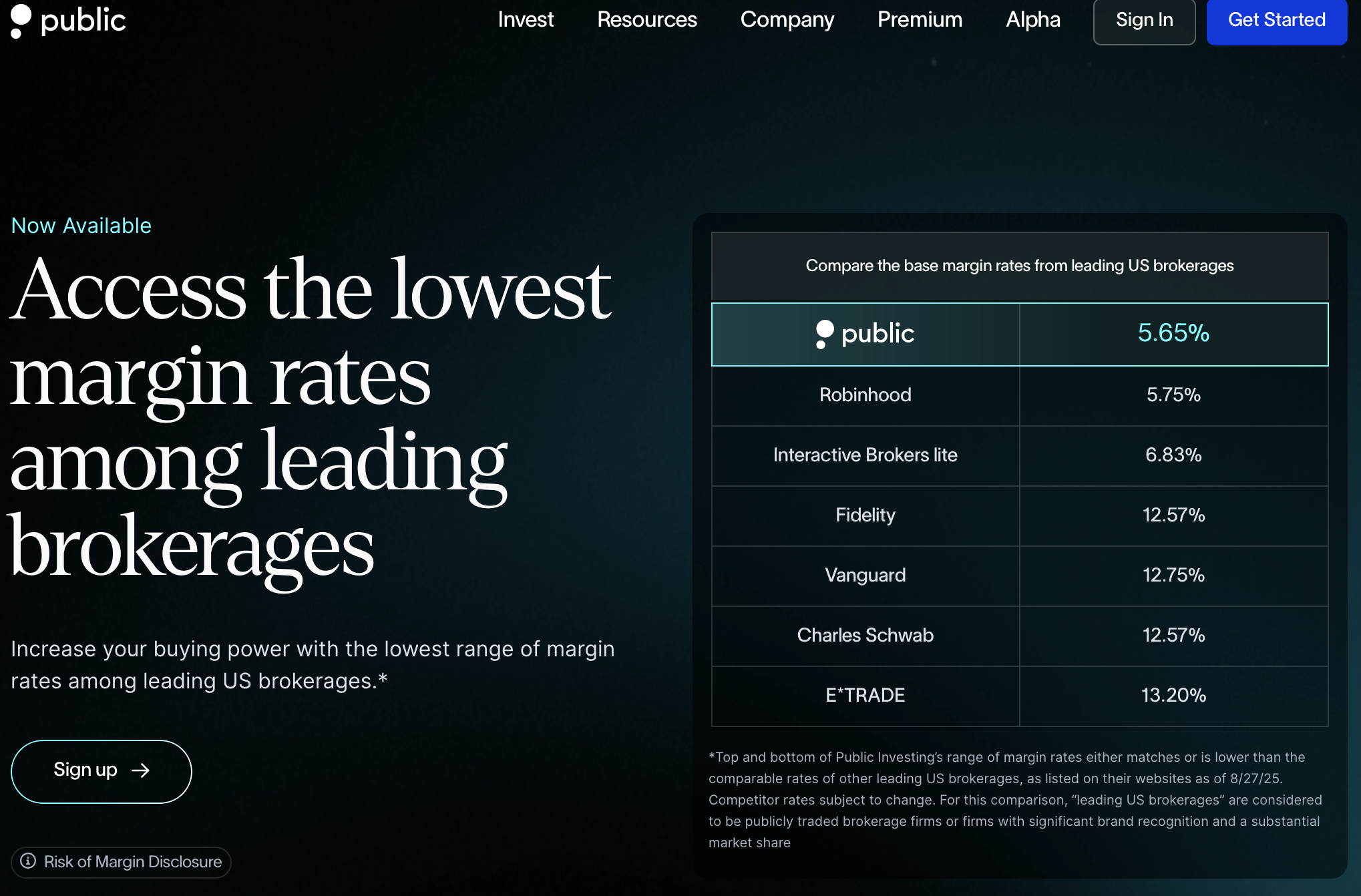

Public

Go to Public to earn an invite-only rebate rate of $0.10 per contract traded. Receive $20 worth of the stock of your choice when you fund your account with $1,000 or more.

The app is sleek, intuitive, and designed in a way that makes investing in stocks and ETFs feel almost effortless. Whether it’s AI-driven research, fixed income portfolios, or alternative assets, Public is trying new things.

Alpha provides AI-powered summaries and recaps on the assets you care about. Just click on the “Alpha” button at the bottom of any news alerts you receive in your inbox.

Many tools I consider essential, like analyst ratings, earnings forecasts, and key fundamental data, are locked behind a premium subscription. While Public shines as a beginner-friendly space to build a simple portfolio, it doesn’t offer enough depth for anyone who wants to analyze investments or trade beyond the basics.

Public also offers alternative assets like fractional shares of art, collectibles, and luxury handbags.

Public.com offers commission-free trading on stocks and ETFs, which is great.

Extended hours trading will cost you $2.99 per trade unless you’re a premium member, and many research tools that come standard elsewhere are locked behind a paywall.

You’re nudged toward a premium subscription to access basic features — things like analyst reports and reinvestment options that other brokers offer for free. A Public Premium subscription costs $10 per month (or $96 annually) after a 7-day free trial, although this cost is waived if you maintain an account balance over $50,000 (subject to terms and conditions). There’s also a fee for small, inactive accounts, which feels a bit out of step with the low-cost brokerage trend.

Gemini

At Gemini trade at least $100 to earn $50 in the crypto of your choice. Sign up and trade at least $100 to earn $50 in the crypto of your choice. The more you trade, the more you and your friend will earn!

Gemini offers more than 80 cryptocurrencies, including Bitcoin and Ether, as well as a limited selection of crypto-to-crypto trading pairs.

Gemini has low minimum trade amounts, which vary by the type of cryptocurrency you want to trade. For example, the minimum Bitcoin trade is 0.00001 BTC.

Gemini’s fees are slightly higher than some other crypto brokerages and vary depending on the platform you’re using. Gemini doesn’t charge transaction fees for deposits from U.S. bank accounts or wire transfers (although your bank might). But If you’re using a debit card for purchases, the fee is 3.49%, and other fees may apply.

For mobile and web users, Gemini charges a flat 0.5% above the current trading price (which Gemini calls its “convenience fee”).

On top of that, it charges a transaction fee, similar to Coinbase, based on the amount traded: a tiered flat fee up to $200; orders above $200 are charged 1.49%. So, together, the fee to buy $200 worth of Bitcoin would be about 1.99%.

Gemini previously offered a Gemini Earn program that advertised rewards on some cryptocurrencies. But in November 2022, the company said it had to delay withdrawals from that program amid the fallout from the collapse of rival exchange FTX. By June 2024, Gemini announced that it had returned 100% of the assets that it owed back to customers. The company has since restarted a modest rewards program through its staking offering, with three eligible assets earning somewhere between 3% and 4%.

Fundrise

At Fundrise, just enter your email and earn a $25 voucher when you sign up. Fundrise is an online real estate company that gives investors access to private real estate deals and venture capital. These investments can be high risk, but may offer high rewards.

There is a quiz to help you identify the plan that is right for you. Though you can change plans at any time, doing so won't change existing investments — it will only apply to new investments, including reinvested dividends.

Investors purchase shares of Fundrise's funds by investing in one of its core plans: Supplemental Income, Balanced Investing, Long-Term Growth or Venture Capital. Fundrise determines the mix of REITs and funds in each plan, as well as the underlying properties. In the case of the Venture Capital plan, clients get access to private technology companies.

While many online real estate, venture capital and alternative asset platforms are available only to accredited investors — defined in U.S. securities law as having a net worth of more than $1 million, not including the value of a primary residence, or annual income of at least $200,000 for individuals or $300,000 for a couple — many of Fundrise’s products are available to all investors.

Redemptions can be tricky with real estate and alternative asset platforms, as many investments are illiquid for an extended period of time. However, with Fundrise, the Flagship, Supplemental Income and Innovation Plans impose no early redemption penalty.

There’s no broker-dealer acting as a middleman at Fundrise, and that saves on costs. However, with any real estate deal, there are costs that are difficult for investors to see. While Fundrise clearly notes its asset management and advisory fees, Fundrise also notes that its funds reserve the right to charge additional fees, such as development or liquidation fees, for work on specific assets.

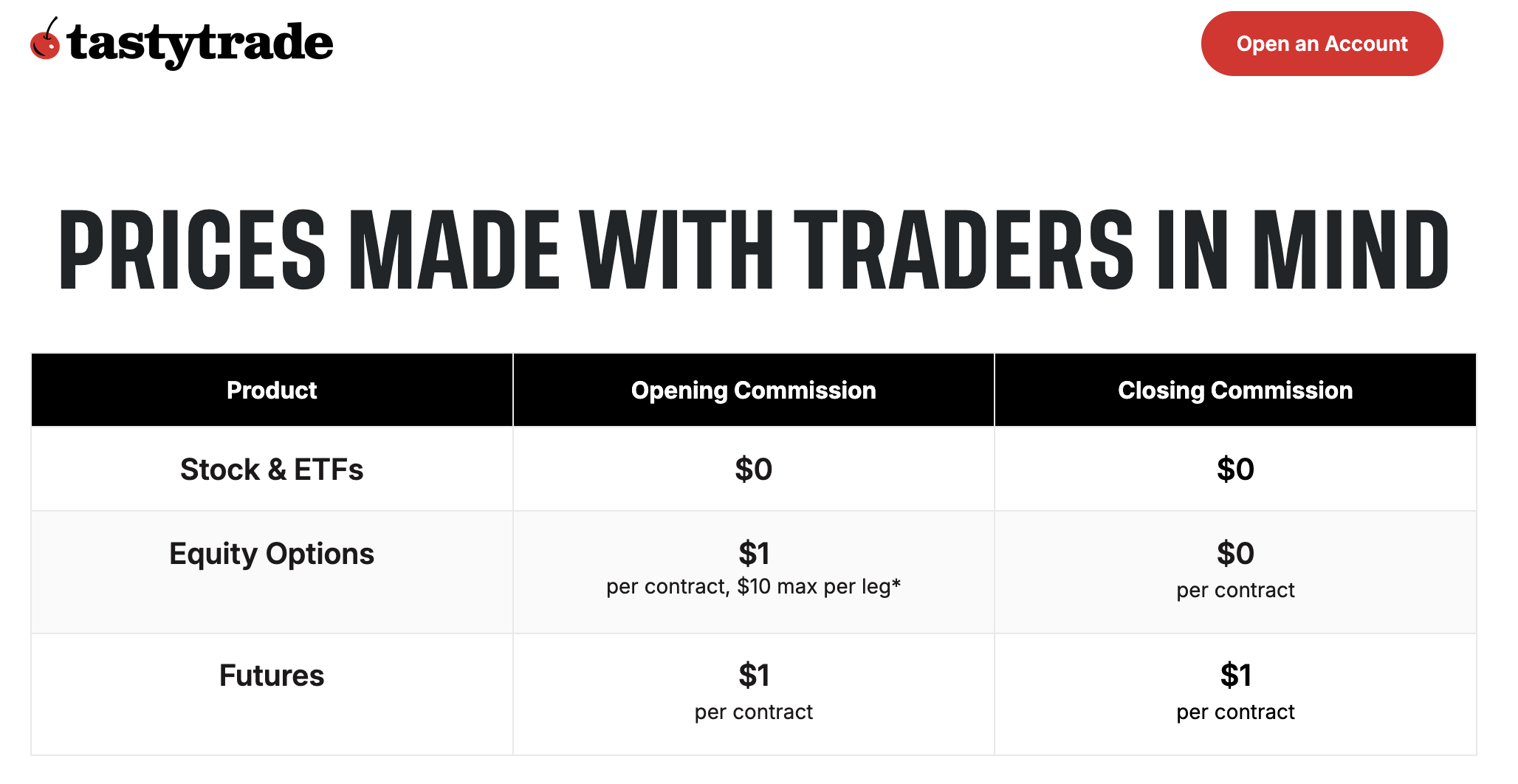

Tasty Trade

Another trading platform for more advanced users is TastyTrade.

Tastytrade offers investors access to stocks, ETFs, ADRs, REITs, options, index options, futures, cryptocurrencies and Treasury products.

If you're looking for a lightning-fast platform with an impressive interface, tastytrade has it. Tastytrade is available on the web, on a desktop platform and a mobile app. The mobile app scores well and is available for both iOS and Android. Tastytrade has some pretty cool features too: The Follow Feed allows you to see trades from select traders via tastylive (tastytrade's network that produces tons of original content) and the in-platform video feed lets you watch real traders whenever the market is open.

Tastylive, a network that streams 7 days a week produces hours of "hard-hitting, probabilistic content." Tastylive has over 100 original segments and 20 on-air traders to help you make informed trading decisions. There's a solid Learn Center that offers full courses, from a Beginner Options Course to a Deep Dive: Implied Volatility Course.

Most brokers charge a flat fee per options contract, such as $0.65 per contract. But tastytrade charges $1 to open and $0 to close. Essentially, this breaks down to $0.50 per contract since you're only paying that $1 fee once, whereas with other brokers, you have to pay the $0.65 fee on each side. With tools like customizable options chains, advanced multileg strategy builders, and integrated metrics such as probability of profit (POP) and net Greeks, the platform supports traders at every level.

MoneyLion

MoneyLion is a app with features like cash advances, credit-building loans, and investing tools. The MoneyLion proposition bundles no-fee checking with investing and borrowing through a digital offering that educates, rewards, and supports members in achieving new financial goals. The investment community recommends staying away from this app.

MoneyLion is a mobile banking platform that offers credit builder loans up to $1,000, interest-free cash advances, banking with early paycheck deposit and no minimum balance, managed investing, cashback rewards, and financial tracking and education.

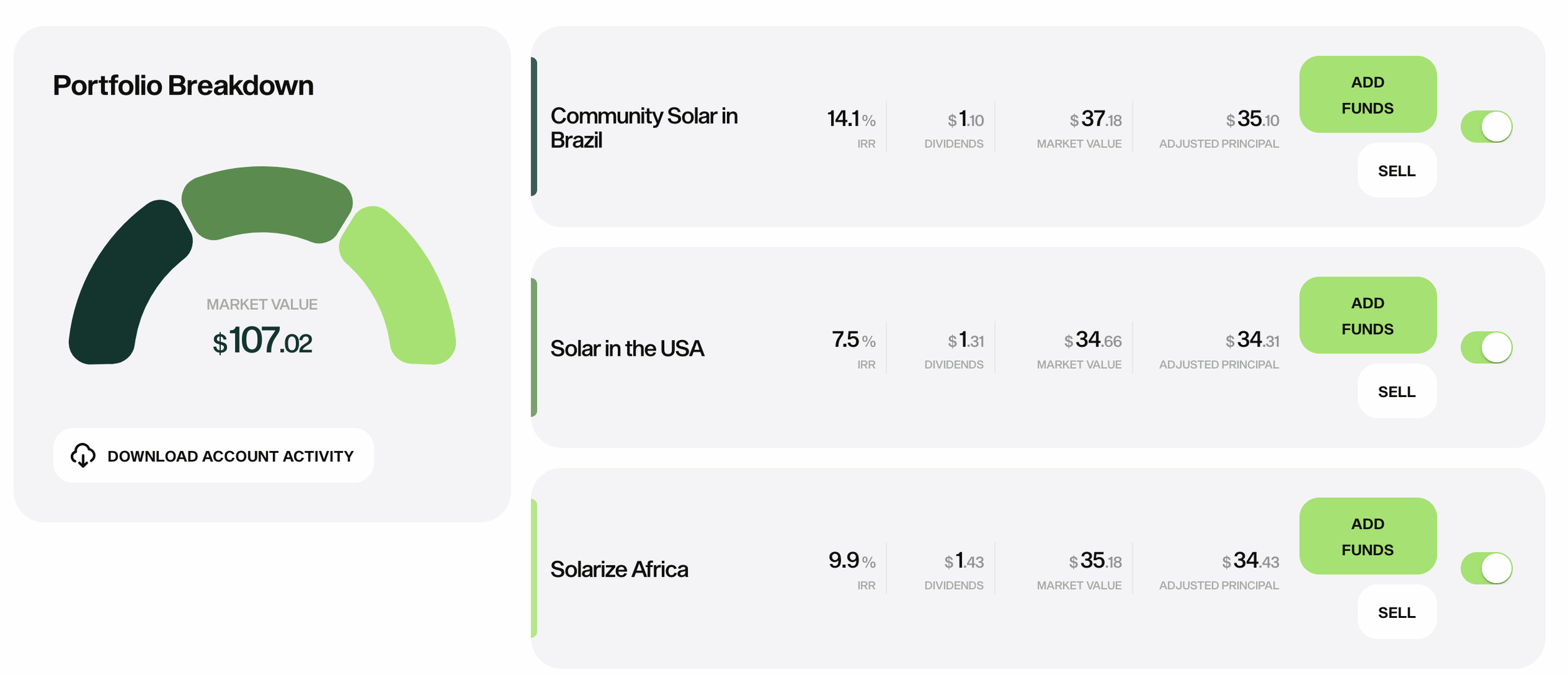

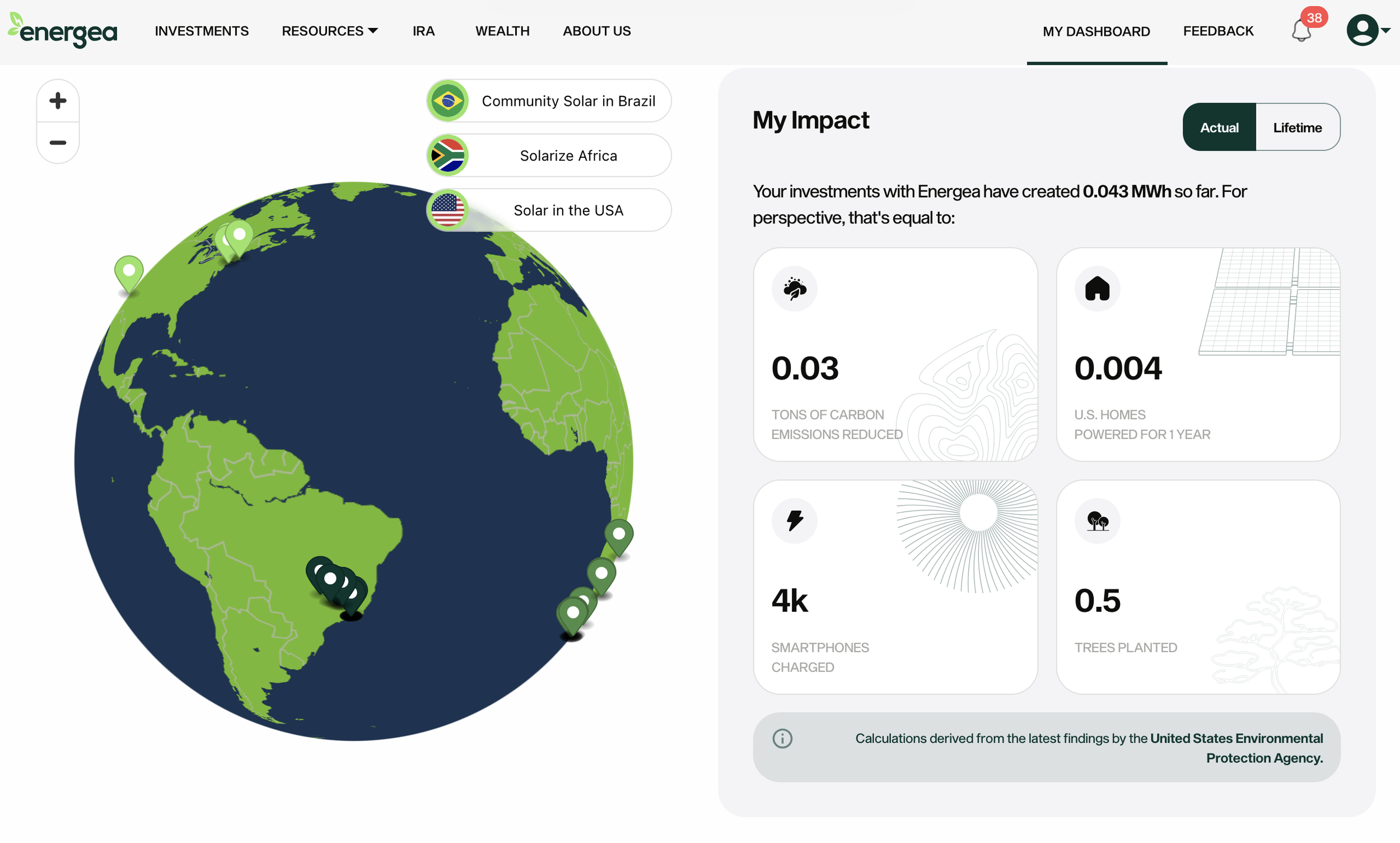

Energea

I signed up for Energea to get dividends from investing in renewable energy developments. I only invested a small amount so I could track how it works. I’ve earned an average of 10% on my investment over a 7 month period and even more importantly I supported investments in solar projects globally. For signing up at Energea on you get $50, to be invested in Community Solar in Brazil portfolio

My impact has been small since I only invested $100 with Energea. With this amount I helped remove carbon, charge smartphones, and plant trees while limiting carbon emissions. This can get you one step closer to becoming carbon neutral, and if you travel by airplane you will need this.

OKX

OKX is more than just a crypto exchange—it’s a powerful super app that brings both CeFi and DeFi products together in one place. Now available in the US, OKX offers a seamless experience for all things crypto.

OKX supports the deposit and withdrawal of USD to and from your bank account, and additional methods like debit cards are being added.

I appreciate they have a learning center where you can grow your crypto and blockchain knowledge, from market analysis to the latest tokens and protocols.